Underwriting

This article provides an overview of underwriting in the Socotra Insurance Suite.

Overview

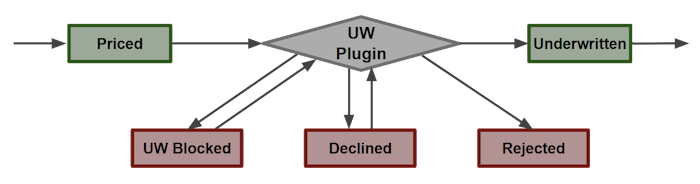

In the Socotra Insurance Suite, underwriting is a process that determines whether a quote or policy transaction is worthwhile from a business standpoint.

Typically, underwriting utilizes an underwriting plugin. The underwriting plugin uses custom logic (written in Java) to analyze a transaction.

Based on its analysis, the underwriting plugin assigns underwriting flags to the transaction.

What is an underwriting plugin?

An underwriting plugin is a module that contains custom logic (written in Java) to perform underwriting checks.

The underwriting transaction is capable of adding and clearing (removing) underwriting flags.

The plugin determines if the transaction passes underwriting. If so, the flow continues. If not, the transaction diverts to a blocked state.

What is an underwriting flag?

An underwriting flag is a marker that can be added to a transaction. Underwriting flags are either:

Added manually (via the API or web app)

Added programmatically (via an underwriting plugin)

There are five types of underwriting flags:

approveblockdeclineinforeject

Once underwriting flags have been applied to a transaction, the system performs an evaluation process to analyze whether the transaction should proceed.

Post-underwriting Evaluation

After a transaction goes through pricing, the typical next step is for it to go through an underwriting plugin. The underwriting plugin adds or clears any flags on the transaction.

The next step is evaluation, where an algorithm determines the appropriate course of action for a transaction given its assigned flags. Then, the transaction is assigned an underwriting status.

Evaluation algorithm

The evaluation algorithm examines the remaining uncleared flags on a quote. The system makes the following checks in order:

If there are any

approveflags assigned to the quote, underwriting passes. The transaction will transition to the desired state.If there are any

rejectflags assigned to the quote, underwriting fails. The quote state will be set torejected.If there are any

declineflags assigned to the quote, underwriting fails. The quote state will be set todeclined.If there are any

blockflags assigned to the quote, underwriting fails. The quote state will be set tounderwritingBlocked.Otherwise, underwriting passes.

Tips

Based on the algorithm described above, we suggest the following tips:

If you never want to block underwriting, avoid adding any flags (or only add

approveorinfoflags).If your decision making logic is in a system external to Socotra, fetch that system’s result in the underwriting plugin. Based on result, add an

approve,reject, ordeclineflag. Evaluation will proceed as described above.If you have a system where you also need to accomplish certain checks (e.g. property inspection or manual review), you can add (and subsequently clear)

blockflags for each task.

Underwriting status

Every quote has an underwritingStatus property that indicates the underwriting decision applied to the quote.

approvedblockeddeclinednonerejected

Important

The rejected underwriting status is terminal. You cannot reset a transaction of its underwriting status when it is rejected. If this is not acceptable, we recommend using the decline or block flags as alternatives.

Example Underwriting Scenario

A commercial auto quote advances to underwriting, and the Underwriting Plugin adds a block flag to the vehicle schedule element, resulting in the following QuoteUnderwritingResponse:

{

"quoteLocator": "01JHN92K8KJTRV8ZBHKN9QAF41",

"accountLocator": "01JHG7ZM32ET1R1JFRRB80BXSS",

"quoteState": "underwrittenBlocked",

"productName": "CommercialAuto",

// ...,

"underwritingStatus": "blocked",

"underwritingFlags": [

{

"locator": "01JHN9AQD6JS0Q67MNGCQSZ2Z5",

"level": "block",

"referenceType": "quote",

"referenceLocator": "01JHN92K8KJTRV8ZBHKN9QAF41",

"note": "Vehicle schedules with TIV over $100K must be reviewed by an underwriter",

"tag": "uw_rule_01",

"elementLocator": "01JHN92K8KZCSHX4QEJMBRTKAS",

"createdTime": "2025-01-15T15:29:21.318840Z"

}

]

}

The quote is currently blocked.

Later, an underwriter decides that this quote looks acceptable and should be advanced to underwritten. She decides to clear the flag while also adding an additional informational flag to the vehicle schedule element. Here’s the body of the corresponding Update Underwriting Flags for Quote, exemplifying underwriting via the API:

{

"addFlags": [

{

"level": "approve",

"elementLocator": "01JHN92K8KZCSHX4QEJMBRTKAS",

"note": "Acceptable risk"

}

],

"clearFlags": [

"01JHN9AQD6JS0Q67MNGCQSZ2Z5"

]

}

The manual underwriting update results in the following QuoteUnderwritingFlagsResponse:

{

{

"quoteLocator": "01JHN92K8KJTRV8ZBHKN9QAF41",

"flags": [

{

"locator": "01JHN9R36S986XH99HDVABM5EW",

"level": "approve",

"referenceType": "quote",

"referenceLocator": "01JHN92K8KJTRV8ZBHKN9QAF41",

"note": "Acceptable risk",

"elementLocator": "01JHN92K8KZCSHX4QEJMBRTKAS",

"createdBy": "dc68c494-6918-487a-bf08-58c2983175dc",

"createdTime": "2025-01-15T15:36:39.385573Z"

}

],

"clearedFlags": [

{

"locator": "01JHN9AQD6JS0Q67MNGCQSZ2Z5",

"level": "block",

"referenceType": "quote",

"referenceLocator": "01JHN92K8KJTRV8ZBHKN9QAF41",

"note": "Vehicle schedules with TIV over $100K must be reviewed by an underwriter",

"tag": "uw_rule_01",

"elementLocator": "01JHN92K8KZCSHX4QEJMBRTKAS",

"createdTime": "2025-01-15T15:29:21.318840Z",

"clearedBy": "dc68c494-6918-487a-bf08-58c2983175dc",

"clearedTime": "2025-01-15T15:36:39.385009Z"

}

]

}

}

Since the block flag has been cleared, and there are no other uncleared blocking flags, the quote can proceed to underwritten when the underwriter attempts to underwrite the quote again.